cleaning our text#

In this section we will clean the bill text that we scraped from the last section. We will do this in the following steps:

get our text (if we don’t already have it loaded up) from either scraping or loading the file from the previous section.

inspect our text to identify elements that we want to clean

write loops to remove these elements from the text

learn about functions so we can write one to clean our text in an automatic way

keep improving the funtion to clean more and more elements

Then, at the end, we will look at other tools (ChatGPT and OpenRefine) to help with the cleaning process.

# run the lines below to load up the text from the course website

import requests

source = requests.get('https://bit.ly/transgender_text')

text = source.content

text[:100]

b'<html><body><pre>\n[Congressional Bills 117th Congress]\n[From the U.S. Government Publishing Office]\n'

type(text)

bytes

text = text.decode('utf-8')

# alternatively, uncomment the bottom four lines to load it from your own space

# notice that the data is already in a string format.

# load = open('sample.txt')

# loaded_text = load.read()

# load.close()

# loaded_text[:100]

inspecting our text#

Remember slicing? Take some slices of the text to see what elements we want to clean. Come up with a list of things that we want to remove.

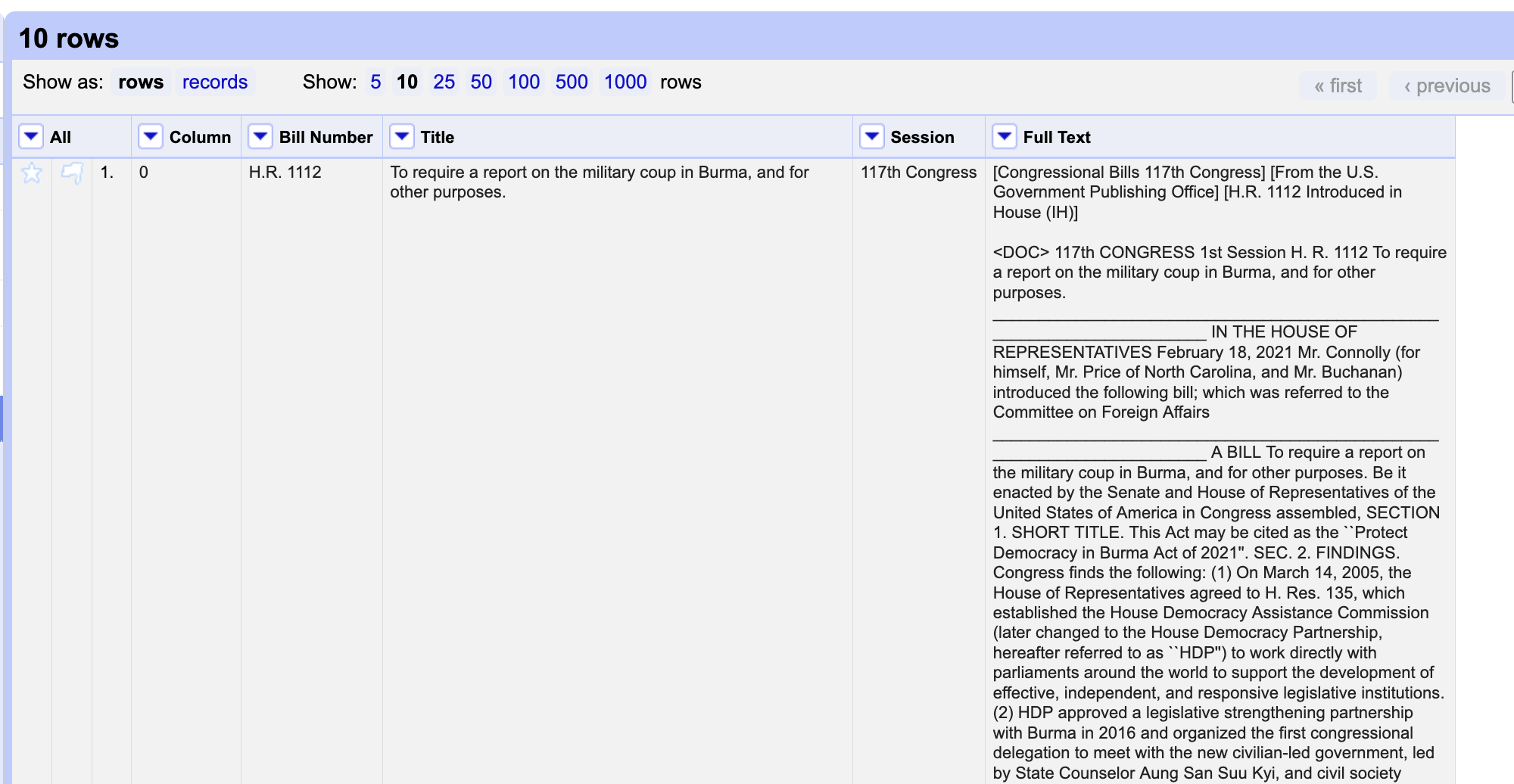

text[:1000]

'<html><body><pre>\n[Congressional Bills 117th Congress]\n[From the U.S. Government Publishing Office]\n[H.R. 1112 Introduced in House (IH)]\n\n<DOC>\n\n\n\n\n\n\n117th CONGRESS\n 1st Session\n H. R. 1112\n\n To require a report on the military coup in Burma, and for other \n purposes.\n\n\n_______________________________________________________________________\n\n\n IN THE HOUSE OF REPRESENTATIVES\n\n February 18, 2021\n\n Mr. Connolly (for himself, Mr. Price of North Carolina, and Mr. \n Buchanan) introduced the following bill; which was referred to the \n Committee on Foreign Affairs\n\n_______________________________________________________________________\n\n A BILL\n\n\n \n To require a report on the military coup in Burma, and for other \n purposes.\n\n Be it enacted by the Senate and House of Representatives of the'

text[3000:4000]

"due to the Burmese military's \n actions directly threatens the democratic trajectory of Burma's \n Parliament, and thereby the country;\n (3) the will and determination of those duly-elected \n Members of Parliament who are taking it upon themselves to \n continue serving as representatives of the people through \n alternative methods of communicating and convening should be \n lauded; and\n (4) by preventing the Parliament from completing its work, \n the Burmese military has rendered impossible and effectively \n nullified the international collaborative relationships that \n have supported and strengthened the institution, including the \n Burmese parliament's partnership with HDP.\n\nSEC. 4. STATEMENT OF POLICY.\n\n It is the policy of the United States to--\n (1) engage with the Association of Southeast Asian Nations \n (ASEAN) and ASEAN member states to--\n (A) condem"

looping through the text to replace() it#

These are the elements we want to clean, as well as the large blank spaces:

\n

/n

\\n

_

[

]

<html><body><pre>

<html><body><pre>

When you have a lot of items to remove at once, it’s best to put them into a list. Then we can write a loop that goes through each item in the “take out” list to see if it’s in the text data. If it is, we will replace that item with a blank space.

to_take_out = ['\n', '/n', '\\n', '_', '[', ']', '<html><body><pre>', '<html><body><pre>', ' ']

for item in to_take_out:

if item in text:

# here is a complicated line of code:

# we are replacing the item with nothing, indicated by two quotes

# then we are saving those results to "text", effectively overwriting

# the variable.

text = text.replace(item, '')

text[:1000]

"Congressional Bills 117th CongressFrom the U.S. Government Publishing OfficeH.R. 1112 Introduced in House (IH)<DOC>117th CONGRESS1st SessionH. R. 1112 To require a report on the military coup in Burma, and for otherpurposes.IN THE HOUSE OF REPRESENTATIVES February 18, 2021Mr. Connolly (for himself, Mr. Price of North Carolina, and Mr. Buchanan) introduced the following bill; which was referred to the Committee on Foreign Affairs A BILLTo require a report on the military coup in Burma, and for otherpurposes.Be it enacted by the Senate and House of Representatives of the United States of America in Congress assembled,SECTION 1. SHORT TITLE.This Act may be cited as the ``Protect Democracy in Burma Act of 2021''.SEC. 2. FINDINGS.Congress finds the following:(1) On March 14, 2005, the House of Representatives agreed to H. Res. 135, which established the House Democracy Assistance Commission (later changed to the House Democracy Partnership, hereafter referred to as ``HDP'') to work di"

challenge: replacing with spaces#

Notice that now some of the words in our dataset are joined with other words. That’s because we took out the new lines. How could we change the code so that we keep spaces between words?

function to automate cleaning#

Let’s say we want to do this to many bits of text, not just one. We could automate the work by writing a function that can run on as many texts as we want.

Functions have two key components: the definition and the call. You first define the function and what it does, then you “call” it to get it to work on a particular piece of data.

Let’s start with the definition. First, you name the function, and include parentheses for your parameters (more on this in a moment). Then, in the body of the definition, you write whatever python code you want to execute for that function. Finally, you have a return statement that saves or “returns” the result, so to speak, from the function.

def add(x,y):

answer = x + y

return answer

Then we call the function.

add(5, 10021)

10026

The basic idea is that the input data, whatever data you want the function to work with, goes inside the parentheses. So that within the body of the function definition, that input data (known formally as “parameters”) gets assigned to whatever variable is in the definition.

This makes functions portable, so to speak, as you can write one, then call it using whatever input data that you like.

What would a function for our text cleaner look like?

# remove all the characters in the "take out" list by writing a

# loop that replaces those characters with an empty character, ''

def clean_up(data):

to_take_out = ['\n', '/n', '\\n', '_', '[', ']', '<html><body><pre>', '<html><body><pre>', ' ']

for item in to_take_out:

if item in data:

data = data.replace(item, '')

return data

cleaned = clean_up(text)

cleaned[:1000]

"Congressional Bills 117th CongressFrom the U.S. Government Publishing OfficeH.R. 1112 Introduced in House (IH)<DOC>117th CONGRESS1st SessionH. R. 1112 To require a report on the military coup in Burma, and for otherpurposes.IN THE HOUSE OF REPRESENTATIVES February 18, 2021Mr. Connolly (for himself, Mr. Price of North Carolina, and Mr. Buchanan) introduced the following bill; which was referred to the Committee on Foreign Affairs A BILLTo require a report on the military coup in Burma, and for otherpurposes.Be it enacted by the Senate and House of Representatives of the United States of America in Congress assembled,SECTION 1. SHORT TITLE.This Act may be cited as the ``Protect Democracy in Burma Act of 2021''.SEC. 2. FINDINGS.Congress finds the following:(1) On March 14, 2005, the House of Representatives agreed to H. Res. 135, which established the House Democracy Assistance Commission (later changed to the House Democracy Partnership, hereafter referred to as ``HDP'') to work di"

Finally, we save our text. And that’s it!

with open('clean_sample.txt', 'w') as f:

f.write(cleaned)

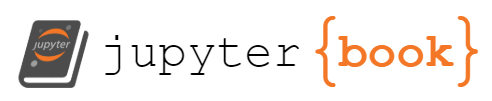

cleaning with chatgpt#

prompt: clean all of the blank spaces and extraneous characters from this text with python.#

import re

from html import unescape

def clean_text(text):

# Remove HTML tags

text = re.sub(r'<.*?>', '', text)

# Unescape HTML entities

text = unescape(text)

# Remove extra blank lines and whitespace

text = re.sub(r'\n\s*\n', '\n', text) # Remove multiple newlines

text = re.sub(r'\s+', ' ', text).strip() # Normalize spaces

return text

text = clean_text(text)

text[:10000]

"Congressional Bills 117th CongressFrom the U.S. Government Publishing OfficeH.R. 1112 Introduced in House (IH)<DOC>117th CONGRESS1st SessionH. R. 1112 To require a report on the military coup in Burma, and for otherpurposes.IN THE HOUSE OF REPRESENTATIVES February 18, 2021Mr. Connolly (for himself, Mr. Price of North Carolina, and Mr. Buchanan) introduced the following bill; which was referred to the Committee on Foreign Affairs A BILLTo require a report on the military coup in Burma, and for otherpurposes.Be it enacted by the Senate and House of Representatives of the United States of America in Congress assembled,SECTION 1. SHORT TITLE.This Act may be cited as the ``Protect Democracy in Burma Act of 2021''.SEC. 2. FINDINGS.Congress finds the following:(1) On March 14, 2005, the House of Representatives agreed to H. Res. 135, which established the House Democracy Assistance Commission (later changed to the House Democracy Partnership, hereafter referred to as ``HDP'') to work directly with parliaments around the world to support the development of effective, independent, and responsive legislative institutions.(2) HDP approved a legislative strengthening partnership with Burma in 2016 and organized the first congressional delegation to meet with the new civilian-led government, led by State Counselor Aung San Suu Kyi, and civil society leaders in May 2016.(3) On February 2, 2021, the U.S. Department of State assessed that Daw Aung San Suu Kyi, the leader of Burma's ruling party, and President Win Myint, the duly elected head of government, were deposed in a military coup on February 1, 2021.(4) As part of the military coup, the Burmese military declared martial law, suspended the civilian-led government, and detained newly elected Members of Parliament in the capitol, Naypyidaw, thereby usurping the role of the democratically elected government and parliament.SEC. 3. SENSE OF CONGRESS.It is the sense of Congress that--(1) due to the Burmese military's seizure of government through the detention of State Counsellor Aung San Suu Kyi, President Win Myint, and other government leaders, Burma is not represented by a democratically elected government;(2) the inability of newly elected Members of Parliament to begin their official mandate due to the Burmese military's actions directly threatens the democratic trajectory of Burma's Parliament, and thereby the country;(3) the will and determination of those duly-elected Members of Parliament who are taking it upon themselves to continue serving as representatives of the people through alternative methods of communicating and convening should be lauded; and(4) by preventing the Parliament from completing its work, the Burmese military has rendered impossible and effectively nullified the international collaborative relationships that have supported and strengthened the institution, including the Burmese parliament's partnership with HDP.SEC. 4. STATEMENT OF POLICY.It is the policy of the United States to--(1) engage with the Association of Southeast Asian Nations (ASEAN) and ASEAN member states to--(A) condemn the military coup in Burma;(B) urge the unconditional release of detained democratically elected leaders and civil society members; and(C) support a return to Burma's democratic transition; and(2) instruct, as appropriate, representatives of the United States Government to use the voice, vote, and influence of the United States at the United Nations to hold accountable those responsible for the military coup in Burma.SEC. 5. REPORT.Not later than 90 days after the date of the enactment of this Act, the Secretary of State shall submit to the Committee on Foreign Affairs and the Committee on Appropriations of the House of Representatives and the Committee on Foreign Relations and the Committee on Appropriations of the Senate a report on the military coup in Burma, including a description of efforts to implement the policy specified in section 4. <all>Congressional Bills 117th CongressFrom the U.S. Government Publishing OfficeH.R. 435 Introduced in House (IH)<DOC>117th CONGRESS1st SessionH. R. 435 To exclude from tax certain payments of Federal pandemic unemploymentcompensation, and for other purposes.IN THE HOUSE OF REPRESENTATIVESJanuary 21, 2021 Ms. Velazquez (for herself, Ms. Norton, Ms. Williams of Georgia, Mr. Smith of Washington, Ms. Jayapal, Mr. Meeks, Mr. Welch, Ms. Schakowsky, Ms. Kaptur, Ms. Tlaib, Ms. Wild, Ms. Newman, Ms. Lee of California, Ms. Meng, and Mr. Nadler) introduced the following bill; which was referredto the Committee on Ways and Means A BILLTo exclude from tax certain payments of Federal pandemic unemploymentcompensation, and for other purposes.Be it enacted by the Senate and House of Representatives of the United States of America in Congress assembled,SECTION 1. SHORT TITLE.This Act may be cited as the ``Excluding Pandemic Unemployment Compensation from Income Act''.SEC. 2. CERTAIN PAYMENTS OF FEDERAL PANDEMIC UNEMPLOYMENT COMPENSATION NOT INCLUDIBLE IN GROSS INCOME OR TAKEN INTO ACCOUNT IN DETERMINING CERTAIN MEANS-TESTED BENEFITS.(a) Exclusion From Gross Income.--For purposes of the Internal Revenue Code of 1986, gross income shall not include the amount specified in section 2104(b)(3) of the CARES Act to the extent such amount is received by the taxpayer pursuant to section 2102, 2104, or 2107 of such Act.(b) Disregarded in the Administration of Federal Programs and Federally Assisted Programs.--For purposes of section 6409 of the Internal Revenue Code of 1986, any amount excluded from gross income under subsection (a) shall be treated in the same manner as a refund under such Code.(c) Effective Dates.--(1) Exclusion.--Subsection (a) shall apply to taxable years ending after the date of the enactment of the CARES Act.(2) Disregard.--Subsection (b) shall apply to amounts received after the date of the enactment of the CARES Act. <all>Congressional Bills 117th CongressFrom the U.S. Government Publishing OfficeH.R. 886 Introduced in House (IH)<DOC>117th CONGRESS1st SessionH. R. 886 To provide funds through the Social Services Block Grant program fordiaper assistance.IN THE HOUSE OF REPRESENTATIVESFebruary 5, 2021Ms. Lee of California (for herself, Mr. Rush, Mr. Carson, Ms. Meng, Mr. Sires, and Mrs. Hayes) introduced the following bill; which was referred to the Committee on Ways and Means A BILLTo provide funds through the Social Services Block Grant program fordiaper assistance.Be it enacted by the Senate and House of Representatives of the United States of America in Congress assembled,SECTION 1. SHORT TITLE.This Act may be cited as the ``COVID-19 Diaper Assistance Act''.SEC. 2. FINDINGS.Congress finds the following:(1) Infants need between 6 to 12 diapers a day. Infants and toddlers lacking access to clean diapers have a greater risk for health complications, which require costly and difficult to access medical care.(2) Prior to the COVID-19 pandemic, surveys indicated that 1 in 3 families in the United States with young children could not afford an adequate supply of diapers to keep their child clean, dry, and healthy.(3) Low-income families pay an even higher than average price for diapers because they do not have access to money saving alternatives such as bulk buying or online shopping that can reduce costs. Low-income families spend about 14 percent of their income on diapers.(4) Clean diaper access presents a financial and stressful burden on families' dependent on child care services. Research indicates that when diaper need is a barrier to child care, parents miss an average of 4 workdays a month.(5) The COVID-19 pandemic has further raised demand for diapers and strained diaper banks' ability to meet low-income families' needs. Prior to the COVID-19 pandemic, nonprofit diaper bank distribution only met 5 to 6 percent of diaper need. Since the start of the COVID-19 pandemic, diaper banks around the country have experienced double, triple, or greater increase in demand for diapers due to the pandemic and economic shutdown. Nonprofits alone cannot fully address this public health crisis that impacts 1 in 3 families in the United States.SEC. 3. TARGETED FUNDING FOR STATES FOR DIAPER ASSISTANCE THROUGH THE SOCIAL SERVICES BLOCK GRANT PROGRAM.(a) Increase in Funding for Social Services Block Grant Program.--(1) In general.--The amount specified in subsection (c) of section 2003 of the Social Security Act (42 U.S.C. 1397b) for purposes of subsections (a) and (b) of such section is deemed to be $1,900,000,000 for fiscal year 2021, of which $200,000,000 shall be obligated by States in accordance with subsection (b).(2) Appropriation.--Out of any money in the Treasury of the United States not otherwise appropriated, there are appropriated $200,000,000, which shall be available for payments under section 2002 of the Social Security Act (42 U.S.C. 1397a), which shall remain available for expenditure through December 31, 2022.(3) Deadline for distribution of funds.--Within 45 days after the date of enactment of this Act, the Secretary of Health and Human Services shall distribute the funds made available by this subsection, which shall be made available to States on an emergency basis for immediate obligation and expenditure.(4) Submission of revised pre-expenditure report.--Within 90 days after a State receives funds made available by this subsection, the State shall submit to the Secretary of Health and Human Services a revised pre-expenditure report pursuant to subtitle A of title XX of the Social Security Act (42 U.S.C. 1397 et seq,.) that describes how the State plans to administer the funds in accordance with subsection (b).(5) Deadline for obligation of funds by states.--A State to which funds made available by this subsection are distributed shall obligate the funds not later than December 31, 2021.(6) Deadline for expenditure of funds.--A grantee to which a State provides funds made available by this subsection (or a subgrantee "

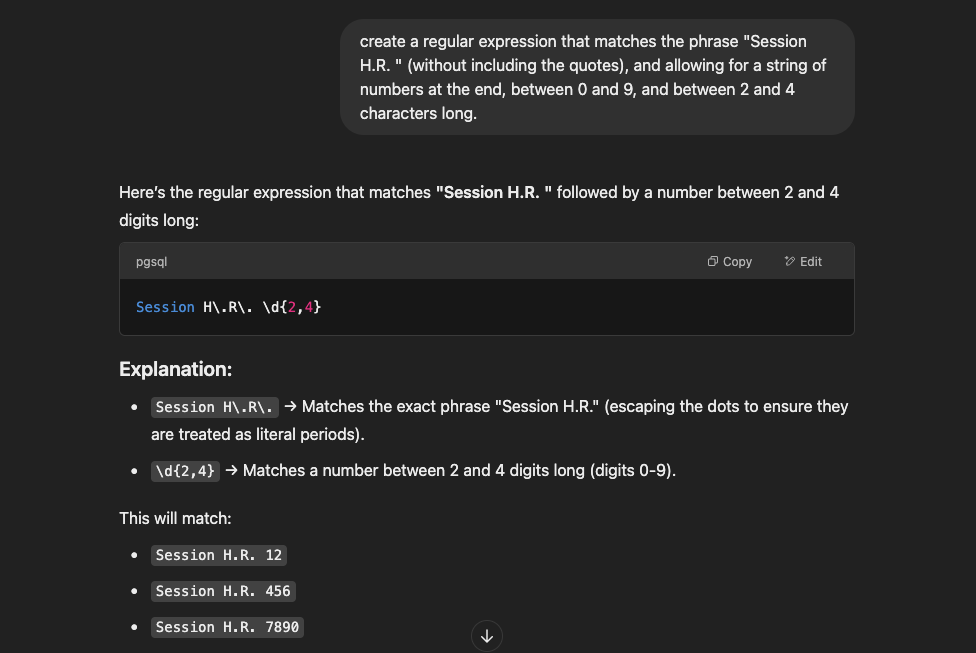

follow-up prompt:#

This text is a collection of legislative bills. Now write me some code that separates the long string of text into individual bills.

def split_bills(text):

# Define a regex pattern to detect the start of a new bill

bill_pattern = re.compile(r'(?=\d{3}th CONGRESS\s+\d{1,2}st Session\s+H\. R\. \d+)', re.MULTILINE)

# Split the text using the pattern

bills = bill_pattern.split(text)

# Remove empty entries and strip whitespace

bills = [bill.strip() for bill in bills if bill.strip()]

return bills

bills = split_bills(text)

type(bills)

list

len(bills)

1

bills[0]